SMALL BUSINESS GUIDES

Your guide to Goods & Services Tax (GST)

Taxable, Input Taxed & GST Free Sales

To become an expert in the types of GST sales that you can make as a small business in Australia, please read on! We’re going to be looking at the three types of sales you can make for GST purposes: taxable sales, GST free sales, and input taxed sales What are...

Taxable, Input Taxed & GST Free Sales

To become an expert in the types of GST sales that you can make as a small business in Australia, please read on! We’re going to be looking at the three types of sales you can make for GST purposes: taxable sales, GST free sales, and input taxed sales What are...

How to calculate GST

Ah, the goods and services tax. Virtually anyone with a small business or sole trader gig in Australia will have to pay attention and learn how to calculate GST. If you’re a small business owner or getting yourself off the ground in the self-employed game, you...

GST refund

When making a GST claim for business expenses, there are several intricacies and responsibilities you need to take into account. It’s prudent to be aware of your rights as a small business owner when approaching the topic of a GST refund. If you’re a small...

GST for small business

Plenty of questions about GST will abound the mind of a new small business owner, whether they be about thresholds, BAS lodgment, GST free sales, ATO requirements, input tax credits, accounting, and tax invoices. But how does GST actually work for small business?...

What is GST?

If you are getting into business in Australia for the first time, taxation, tax law and GST can seem like assumed knowledge. Of course, it isn’t. There is a lot to get your head around in the initial phases of a new business and goods and services taxation is one...

Registering for GST

Do you have burning questions about registering for GST? Well, we have you covered. If you’ve just started a business in Australia, some of the top questions you should be asking yourself are whether you should register for GST and how to register for GST. Let’s...

GST for freelancers

You are out there now, freelancing like you always dreamed of and bosses are a quaint memory in your new normal. Freelancing may be awesome, but how are you handling your new tax requirements, including GST? If you want to learn more about what GST is, or find...

Download your free GST guide

GST guide

There’s a lot to get your head around when you’re starting a new business, and GST is just one bit most fledgling business owners will need to get to grips with. If you’re looking for help, download our free guide to better understand GST.

GST FAQs

When did GST start in Australia?

The Goods and Services Tax came into effect on 1 July 2000. Its goal of the tax was to unify & simplify the existing sales tax system and other differing state and territory taxes with a single 10 per cent tax.

What is the GST threshold?

You must register for GST in Australia, by law, if you conform to the following circumstances:

- Your business has an annual income of over $75,000.

- Your non-profit entity has an annual income of over $150,000.

- You operate a taxi service or business, including ride share services such as Uber, regardless of your annual income.

What is GST turnover?

GST turnover is your total business income. Not just business profit. To calculate your GST turnover you need to calculate your total business income minus any of the following;

- GST included in sales to your customers

- sales that aren’t for payment and aren’t taxable

- sales not connected with an enterprise you run

- input-taxed sales you make

- sales not connected with Australia.

What is the GST on exports?

Exports of goods and services from Australia are generally GST-free. If you’re registered for GST, this means:

- you don’t include GST in the price of your exports

- you can still claim credits for the GST included in the price of purchases you use to make your exported goods and services.

Discover other small business resources

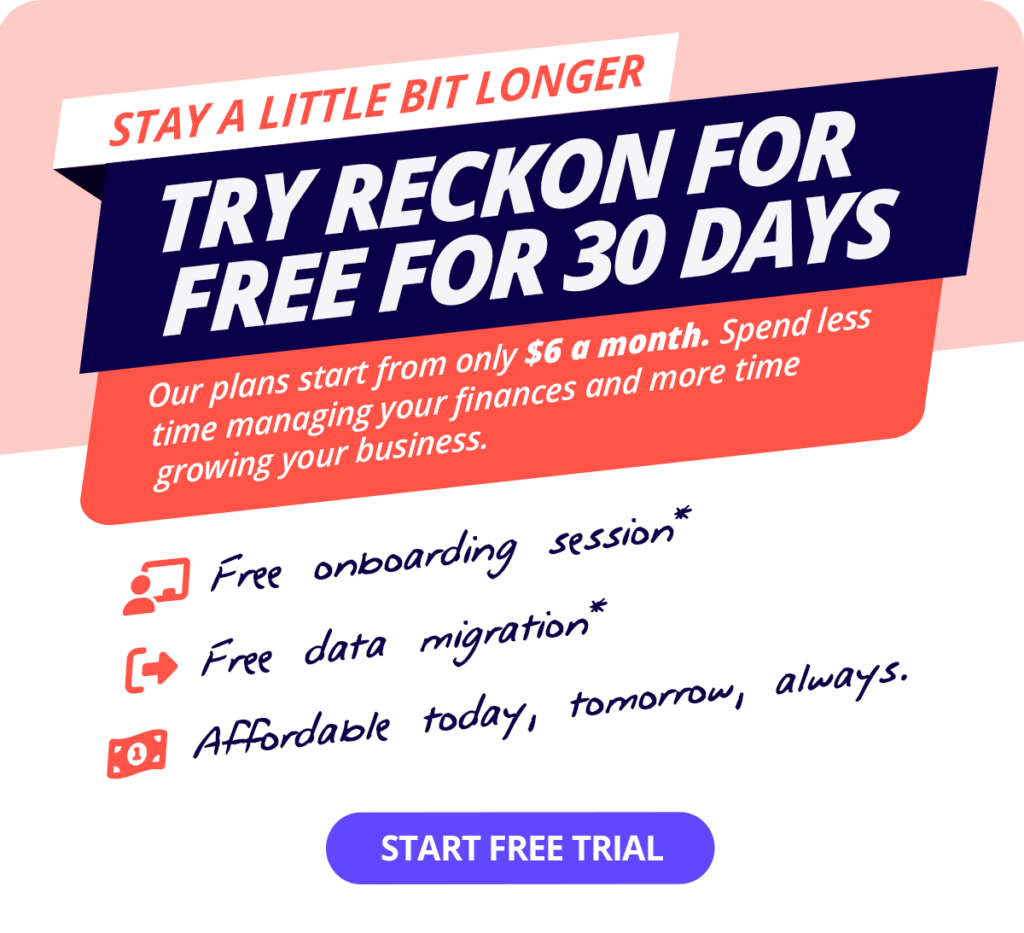

Track and manage GST with Reckon One

Cancel anytime. Unlimited users.