SMALL BUSINESS GUIDES

Your guide to small business bookkeeping

Discover what is bookkeeping and the bookkeeping basics for your small business.

How to do a tax return

Submitting a tax return sits at the heart of compliance with the Australian Taxation Office (ATO). Whether you are a sole trader, partnership, company, or trust, you need to be preparing for taxes every year to ensure your tax responsibilities with the Australian...

How to do a tax return

Filing your tax return to the ATO as a small business owner might seem like an involved process, especially when you’re tackling it for the first time. But depending on your personal preferences and business structure, there’s a variety of options available for lodging your return. Read our article to dive further into this topic.

How to write a financial planning report

Comprising your balance sheets, cash flow and income statements, creating a comprehensive financial planning report for your small business will help paint a clear and insightful picture of its overall financial viability at a specific point in time, empowering you to make informed decisions.

Bookkeeping for freelancers

You’ve started your freelance small business journey but are not sure where to begin with freelance bookkeeping? Don’t worry, with accounting software and a little know-how it’s not such a momentous task. In this article, you will learn the importance of freelance bookkeeping and how freelance bookkeeping works.

Bookkeeping data entry

Whether you’re handling your own finances or working with a professional, data entry is the backbone of bookkeeping. In today’s digital landscape, it’s crucial to grasp modern bookkeeping data entry. Our article will teach you the best practices to ensure your financial records are accurate.

Managing accounts receivable for small businesses

Getting on top of your invoices is vital to driving success. If you issue invoices to get paid, you need to understand how to manage your accounts receivable. Read our article to discover how you can master the art of managing your accounts receivable with ease.

Setting up a chart of accounts

Managing an organised chart of accounts is an important part of small business bookkeeping. Your COA serves as the backbone for tracking financial transactions, categorising expenses, and generating accurate financial reports. To gain a thorough understanding COA in the context of small business operations, read our comprehensive article.

How to do payroll: step-by-step process for small businesses

For first-time employers, handling payroll for your employees may seem daunting. However, by breaking it down into five clear steps, the process becomes much more manageable and straightforward. Read our article for a step by step guide to managing payroll.

Small Business & Bookkeeping: All You Should Know

Put simply, bookkeeping is the process of recording, analysing and interpreting the financial transactions of a business or individual. Small business bookkeeping is an inescapable element of running your own well managed small business. Read the article to find out what is bookkeeping and the bookkeeping basics for your small business.

Why is it important to hire a bookkeeper?

As your new business begins to turn over cash for the first time, you’ll begin to consider when to hire a bookkeeper to help manage your ever-increasing accounting admin. To ensure your small business is afforded the best chance of success, it’s time to understand why you need bookkeeping services.

Day-to-day bookkeeping for your business

Bookkeeping is a fundamental and unavoidable aspect of owning your own business. Sometimes, business owners are better served enlisting a dedicated bookkeeper or accountant to perform tasks on their behalf. Read the article as we delve into the importance of bookkeeping and the value it brings to a business.

Succession planning

Succession planning is as important as a personal will. After all, what actually happens to your business when you retire, want to sell up, or, heaven forbid, pass away? It’s an often-overlooked step that’s easily lost in the busy mix of business life. So, if you haven’t put any thought into succession planning, it’s time to pay it some attention.

Managing accounts payable

When you receive invoices from business suppliers, you need to understand how to manage these in a process known as accounts payable. Our article covers everything you need to know to master accounts payable and keep your financial operations in top shape.

Download your free bookkeeping guide

Bookkeeping Guide

Understand the basics of bookkeeping for small business owners

Bookkeeping FAQs

How will a bookkeeper help your small business?

Here are some ways a bookkeeper will help to keep your business running smoothly:

Keep you compliant

As a small business owner, you’ve got enough to worry about without having to stay up to date with all the legislative compliance changes. That’s exactly how your bookkeeper can help; it’s their job to know about industry updates and compliance changes so you don’t have to. Bookkeepers stay aware of changing laws, so they can ensure your small business is compliant with payroll and tax laws, as well as any other financial rules and regulations that affect your small business.

Help you learn about your business numbers

A great bookkeeper is someone who doesn’t mind sitting down with you and running through the “ins and outs” of all things bookkeeping. They will take the time to explain your business numbers, show you the insights behind them, provide suggestions, tips of the trade and answer your questions without any accounting jargon.

A bookkeeper also keeps track of your company’s financial health and advises you on decisions that can help you grow your business. They can also warn you if you’re about to make a decision that could hinder your longer-term growth.

For more details on why it’s important to hire a bookkeeper, read out article here.

What are the main responsibilities of a bookkeeper?

Bookkeepers oversee a company’s financial data and compliance by maintaining accurate books on accounts payable and receivable, payroll, and daily financial entries and reconciliations. They perform daily accounting tasks such as monthly financial reporting, general ledger entries, and record payments and adjustments. Additionally, many bookkeepers also assist with basic HR duties like new hire documents, compliance, and temporary disability insurance and workers’ compensation filings, making them an indispensable part of an organization’s fiscal fitness.

A bookkeeper’s main responsibilities include:

- Maintains records of financial transactions by establishing accounts; posting transactions; ensure legal requirements compliance.

- Develops system to account for financial transactions by establishing a chart of accounts; defining bookkeeping policies and procedures.

- Maintains subsidiary accounts by verifying, allocating, and posting transactions.

- Balances subsidiary accounts by reconciling entries.

- Maintains general ledger by transferring subsidiary account summaries.

- Balances general ledger by preparing a trial balance; reconciling entries.

- Maintains historical records by filing documents.

- Prepares financial reports by collecting, analyzing, and summarizing account information and trends.

- Complies with federal, state, and local legal requirements by studying requirements; enforcing adherence to requirements; filing reports; advising management on needed actions.

- Contributes to team effort by accomplishing related results as needed.

Do you need a bookkeeper if you have an accountant?

Contrary to popular belief, accountants and bookkeepers perform distinctly different tasks for the businesses they serve. Bookkeepers are responsible for on-going maintenance of their clients’ general ledgers. A bookkeeper’s common responsibilities consist of:

-

Compiling data on a daily basis

-

Categorizing expenses in the general ledger

-

Reviewing the general ledger for accuracy

-

Reconciling bank statements against the general ledger

-

Generating financial statements

Accountants use the accurate and up-to-date general ledger maintained by the bookkeeper to provide advisory services, such as:

-

Analyzing the company’s financial data

-

Preparing income tax returns

-

Providing tax planning advice

Read our article about the key differences between a bookkeeper and an accountant.

Discover other small business resources

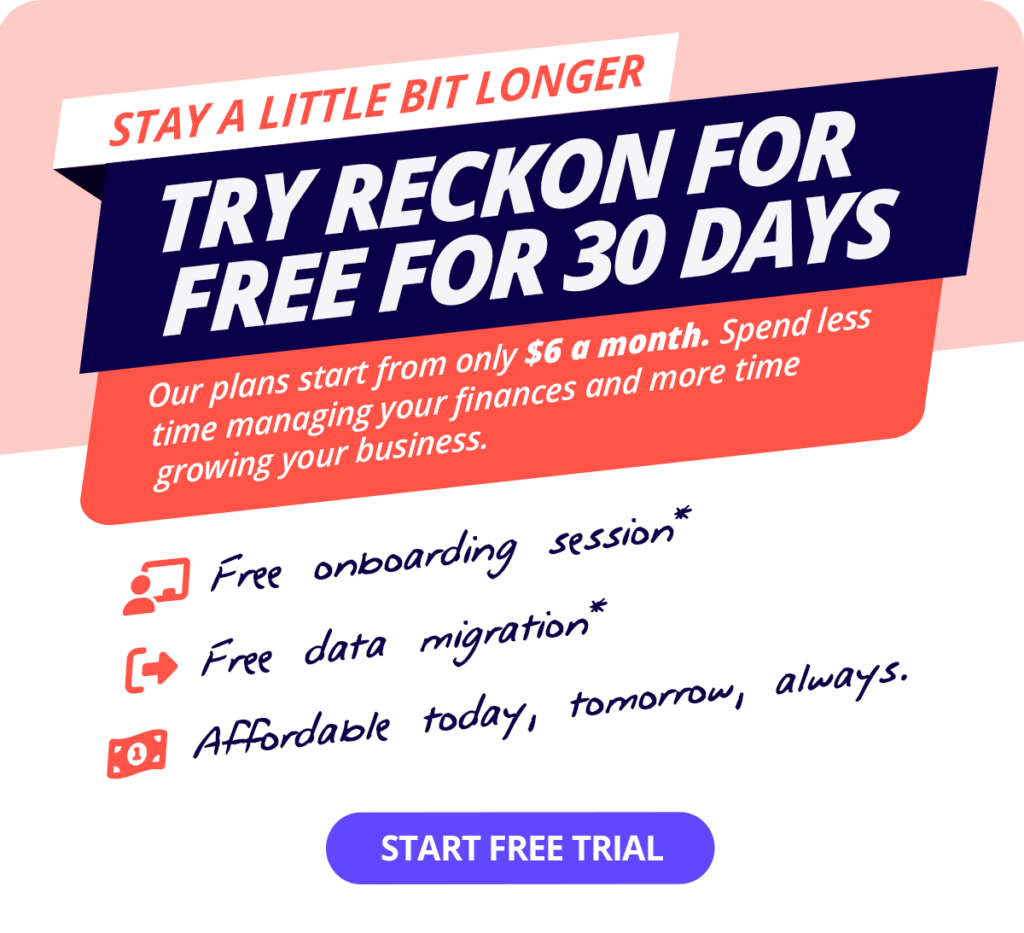

Try Reckon One free for 30 days

Cancel anytime.