Free tax invoice template for small businesses

Create a professional invoice in seconds with our easy-to-use Australian tax invoice template.

Create a professional tax invoice in minutes

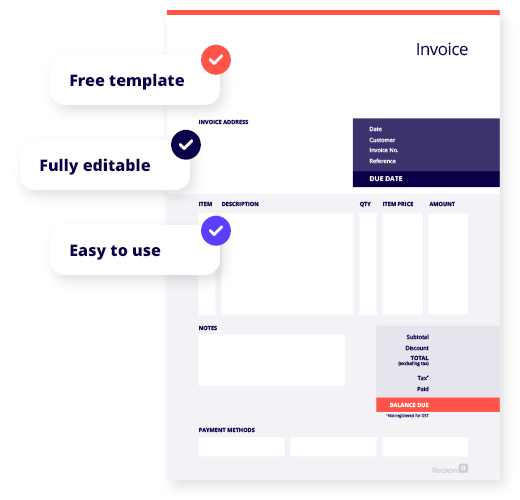

Free template

Our Australian tax invoice template can save you time & money.

Fully editable

Ready to customise with all requirements like business and customer details, notes and goods or services supplied.

Easy to use

Simply add your data and our template will do all the calculations for you.

Download your free tax invoice template

Tax invoice template

Not sure what to include on tax invoices? Use our free customisable Australian tax invoice templates for small business. The easy-to-use editable document contains all the legal requirements of an invoice to help you get paid faster. Simply add your business name and a few other details and you’re ready to go!

Why choose software over a tax invoice template?

Up your invoicing game with Reckon’s unlimited invoicing software and credit card online payments for just $12/month.

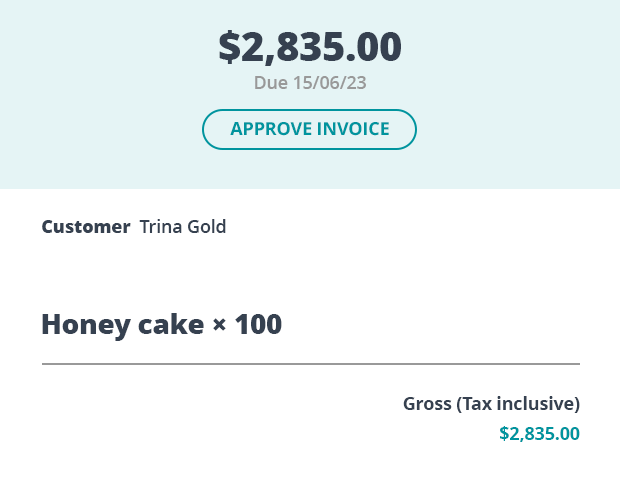

Get paid faster with unlimited online invoicing

Boost cash flow with professional invoices that include a 'Pay now' button for credit card payments. Time-saving features like recurring invoices, payment reminders and templates will shrink your to-do list and ensure you get paid on time.

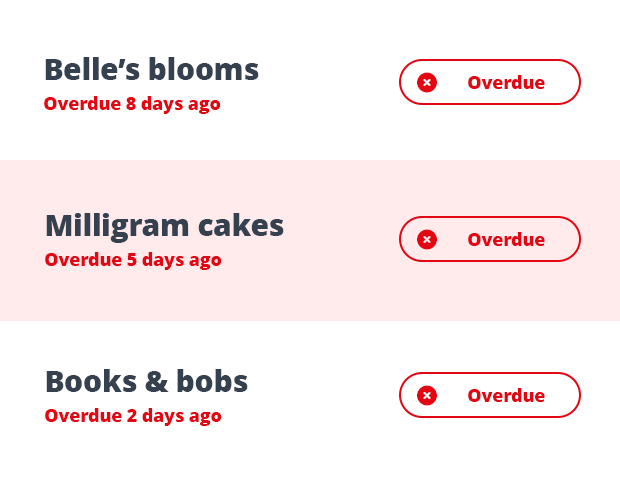

Add recurring invoices & track overdue invoices

Recurring invoices takes the work out of managing invoicing. Easily set up the invoice and your preferred schedule to create the invoices automatically.

You can also check up on overdue invoices to keep track of late payments!

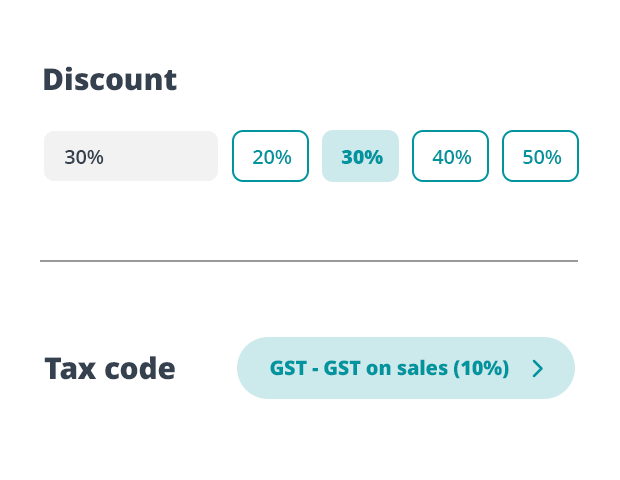

GST, tax codes and compliance are covered

Select preset tax codes to automatically calculate GST and other taxes on your invoices. You can also incorporate discounts and set payment terms with a few taps.

Our invoice template makes it easy to tick all the compliance boxes!

Reckon One software vs free tax invoice template

Features

Free Tax Invoice Template

Manual data entry

Easily add your logo

Easily share online with your customers

Send directly from your mobile

Customers can click to accept and pay online

Free downloadable templates

Invoice template

Free & customisable tax invoice for your small business.

Payslip template

Free & editable payslip template for Aussie small businesses.

Business plan

Free editable business plan template to build out your business strategy.

Cashflow forecast template

Free cashflow forecast template for small businesses.

Balance sheet template

Free & customisable balance sheet for your small business.

Profit & Loss template

Free & editable profit & loss template for Aussie small businesses.

Cashflow statement template

Free cashflow statement template for small businesses.

Quote template

Free quote template for

small businesses.

Business continuity plan template

Free continuity plan template for small businesses.

Frequently asked questions

What is a tax invoice?

An invoice is a request for payment similar to a bill. It lists the products or services you’ve provided to your customer, and what they owe you in return. A tax invoice template has certain legal requirements for things like business name, payment terms and an invoice date. It’s important to get invoicing right because it’s how you get paid and maintain healthy cash flow. If your business is built around providing goods & services chances are invoicing will be a huge part of your daily admin. Our Australian invoice template can save you time & money.

What should I include on a tax invoice template?

Your tax invoice must include the following 7 pieces of information to be valid. These include the words ‘Tax invoice’ – preferably at the top, business name (or trading name), Australian Business Number (ABN), invoice issue date, brief description of the goods or services sold including quantity and price, the GST amount payable (if any) and the extent to which each item sold includes GST. Learn more >

Should I customise my invoice template?

Using a standard layout that is familiar to the majority of your customers will help make it easier for your customers to pay you. However, that doesn’t mean your invoices have to be boring. Add your business branding through the use of business logos, accent colours, font, personal messages or you can even add small advertising to your invoices to entice repeat business.

Why is invoicing important?

An invoice directly results in you getting paid, it will let the buyer know how much they have to pay, when the payment is due, and the ways in which they can pay. Invoicing is also extremely important for tax reasons and staying compliant with ATO. When you run your own business, you are required to keep copies of your invoices to report how much you earned, if you’re GST registered and how much tax you’ve collected.

Are invoices and tax invoices different?

There are 2 different types of invoices. which one you need to use is based on whether your business is registered for GST. Invoice – is for businesses NOT registered for GST. You will use regular invoices and don’t include the words tax invoice. Tax invoice – is for businesses registered for goods and services tax (GST. You will use tax invoices and the must say ‘tax invoice’.

How do I create an invoice?

Use our free tax invoice template! Simply add your business information and any other relevant information and you’re ready to send the invoice to your customer! Then when your business starts growing with new customers and projects it may get to a point where it’s more efficient to get online invoicing software. Check out Reckon’s affordable range here.

What are some tips for invoicing?

- Check formatting, spelling & grammar and ensure invoices are correct before sending. Unprofessional invoices can affect your brand image and even prevent you from getting paid!

- Create an email address specifically for dealing with invoicing and accounting. For example, set up accounts@yourcompany.com and send all your invoices from that email. This will create a stronger impact on the buyer when they are asked to be pay.

- Set crystal-clear terms on the invoice so that you get paid on time, and include late fees associated with late payments on the invoice.