When it comes to preparing and lodging BAS (business activity statements), there are two methods that are offered by the ATO (Australian Tax Office) to work out your GST (goods and services tax) before you prepare and submit your actual business activity statement.

These two methods are known as the ‘calculation worksheet method’ and the ‘accounts method’.

A quick overview of BAS

Before we jump into BAS completion methods, let’s do a brief BAS recap.

Business activity statements are there for businesses to report and pay taxes by detailing their business finances. Your regular BAS form must be submitted depending on your businesses’ reporting period so that the ATO can work out taxes owed. The primary purposes are to work out PAYG tax withheld, to pay GST, and to calculate any other taxes you owe.

Calculation worksheet method

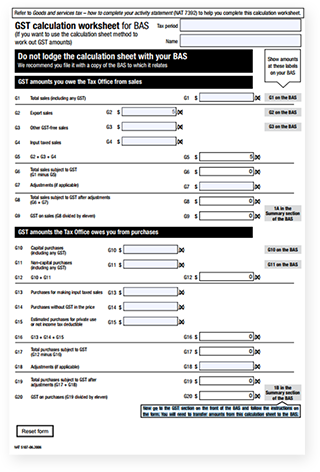

For the calculation worksheet method, download the above worksheet and go through the steps to figure out the correct inputs for your BAS statement. The Business Activity Statement worksheet includes GST labels and fields for you to fill out if they apply to you.

The worksheet will help you:

• Calculate your GST on purchases.

• Calculate your GST on sales.

• Create a set of results to be transferred to your BAS submission.

You don’t actually submit this calculation worksheet when submitting BAS, it’s simply there to help you arrive at the correct figures in the correct fields for subsequent BAS preparation and submission.

Accounts method

The accounts method is the other avenue of arriving at the correct BAS inputs for further submission.

To use this method, you need to use adequate accounting software or otherwise have a complete accounting method which displays enough information.

To use the accounting method, your accounts need to be able to:

• Display the GST amounts of all your sales, purchases and imports.

• Show all imports that were for making input taxed sales or were for private use.

• Identify all your GST-free sales or input taxed sales.

If your accounts can offer all the above, you’ll have what you need to correctly and fully fill out your BAS.

Completing and submitting your BAS

Now that you have the inputs you need – which should be straightforward if you’re using modern accounting software – you need to prepare and submit your BAS.

The method you choose to complete and submit your BAS will depend on your business size, complexity, accounting skills, the time you can allocate to BAS preparation, and personal preferences. Let’s have a look at the methods you can choose.

Paper form

You can obtain paper BAS forms from the ATO and manually fill them out. This method is suitable for small businesses with straightforward transactions or without adequate accounting software.

Online

A very common method is for you to fill out and submit your BAS with the ATO electronically. This can be done through the ATO’s Business Portal. If you’re a sole trader, you can simply use your myGov account.

Accounting software

Accounting Software like Reckon One’s BAS software simplifies your tax obligations by automatically calculating GST in real time and prefilling your BAS. You’ll be able to keep track of your tax liabilities and their due dates, enabling you to efficiently prepare your BAS statement, ready to lodge with the Australian Taxation Office (ATO).

Use a registered BAS agent

Another option favoured by busy people and those with more complex businesses and regular BAS requirements, you can engage a registered BAS agent to assist in preparing and lodging your BAS. These professionals are authorised to provide BAS services.

Whatever method you choose, it’s important to ensure accuracy and compliance with tax regulations. If in doubt, seek advice from a tax professional or the ATO.