Your guide to eInvoicing

Digitally exchange invoices between accounting software systems, without manual data entry.

Everything you need to know about eInvoicing in Australia.

What is eInvoicing?

Electronic invoicing (or eInvoicing) is the new way for businesses to send invoices electronically between a buyer’s and supplier’s accounting software systems, without the need for manual data entry.

With the introduction of eInvoicing, businesses will no longer need to generate paper-based or PDF invoices that must be printed, posted or emailed – reducing costs and improving payment times.

Will it be mandatory for small businesses to use eInvoicing?

As part of the Government’s Digital Business Plan, eInvoicing will be mandatory for all Government departments by 1 July 2022. The Government is currently consulting on options for mandatory adoption of eInvoicing for businesses.

So, for now, you can still choose how you want to invoice your customers, however there are significant benefits to using eInvoicing if you want to reap the rewards earlier.

For more information about the rollout of eInvoicing for Australian businesses visit the ATO website here.

Benefits of eInvoicing

eInvoicing brings a range of benefits to businesses. The direct exchange between accounting software means less manual handling of incoming eInvoices, resulting in greater accuracy, reducing the risk of errors and getting you paid faster.

Einvoicing is paperless, helping you significantly reduce time spent on manual admin and improving efficiency by replacing the need to email PDF invoices with einvoicing software. Plus, electronic invoices are exchanged through a secure and safe network, reducing the risk of interception and fraud.

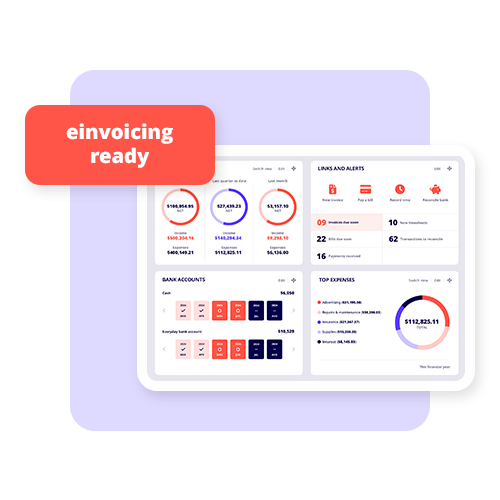

How is Reckon supporting eInvoicing?

Reckon One and Reckon Accounts Hosted are now eInvoicing ready, enabling our customers to save time on invoicing, reduce manual handling and most importantly get paid faster. Learn more about how you can manage eInvoicing with Reckon One and Reckon Accounts Hosted.

Frequently Asked Questions

How does eInvoicing work?

eInvoicing allows a small business to send an invoice from Reckon directly to the accounts payable software of another business or government department, and allows a business to receive an invoice directly into Reckon from a supplier.

What are the benefits of eInvoicing?

eInvoicing brings a range of benefits to businesses. The direct exchange between accounting software means less manual handling of incoming einvoices, resulting in greater accuracy, reducing the risk of errors and getting you paid faster.

Einvoicing is paperless, helping you significantly reduce time spent on manual admin and improving efficiency by replacing the need to email PDF invoices with e-invoicing software. Plus, electronic invoices are exchanged through a secure and safe network, reducing the risk of interception and fraud.

Will it be mandatory for small businesses to use eInvoicing?

As part of the Government’s Digital Business Plan, eInvoicing will be mandatory for all Government departments by 1 July 2022. The Government is currently consulting on options for mandatory adoption of eInvoicing for businesses.

So, for now, you can still choose how you want to invoice your customers, however there are significant benefits to using einvoicing if you want to reap the rewards earlier. For more information about the rollout of einvoicing for Australian business visit the ATO website here.

Plans that fit your business needs and your pocket

30-DAY FREE TRIAL + SAVE 50% FOR 6 MONTHS ON ALL PLANS.

Payroll Essentials

For businesses with up to 4 employees

$6/ month

Was $12

Save $36 over 6 months

Up to 4 employees**

Process pay runs

Email payslips

Manage Single Touch Payroll

Calculate superannuation

Track leave & entitlements

Payroll reporting

Payroll companion app

Employee facing app

Track timesheets

Employee expense claims

Free data migration††

Free onboarding session

Advanced reporting

Payroll Plus

For businesses with up to 10 employees

$12.50 / month

Was $25

Save $72 over 6 months

Up to 10 employees**

Process pay runs

Email payslips

Manage Single Touch Payroll

Calculate superannuation

Track leave & entitlements

Payroll reporting

Payroll companion app

Employee facing app

Track timesheets

Employee expense claims

Free data migration††

Free onboarding session

Advanced reporting

Payroll Premium

For larger businesses

$25/ month

Was $50

Save $150 over 6 months

Unlimited employees**

Process pay runs

Email payslips

Manage Single Touch Payroll

Calculate superannuation

Track leave & entitlements

Payroll reporting

Payroll companion app

Employee facing app

Track timesheets

Employee expense claims

Free data migration††

Free onboarding session

Advanced reporting

† Transactions that exceed the 1000 limit will be subject to the BankData Fair Use Policy.

†† Free data migration offer includes 1 year of historical data + YDT only. Paid subscriptions only.

Helping thousands of businesses with their payroll

Download our free eInvoicing guide

Download our eInvoicing guide for small businesses, that has everything you need to know about sending electronic invoices between a buyer’s and supplier’s accounting software systems!

Start sending eInvoices today!

Cancel anytime. Unlimited users.