Processing JobKeeper payments in your product

Reckon Accounts | Accounts Hosted | Reckon One | Payroll Premier | STP App | Payroll App

JobKeeper Payments Overview

JobKeeper Payments Extension

On July 27, the Prime Minister announced that, while the important measure of JobKeeper will continue, it will do so in a reduced form. This new phase of the scheme will run from September 2020 through to January 2021 with new eligibility tests required. JobKeeper 2.0 will reduce payments to $1,200 per fortnight for full time employees and $750 per fortnight for those working less than 20 hours a week.

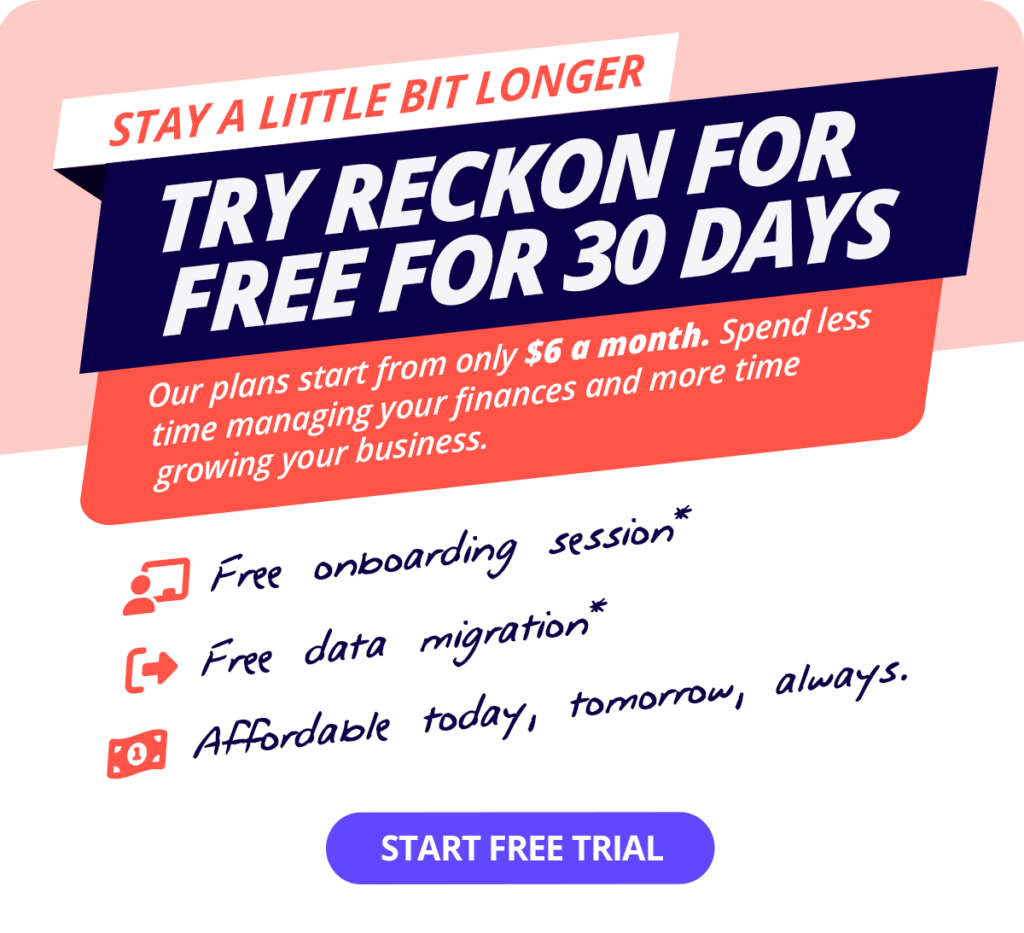

New to Reckon?

Get JobKeeper ready from just $10 a month! We’ve got easy and affordable solutions to suit all businesses.

Frequently asked questions

Answers to the most common questions surrounding JobKeeper Payments.

What are the JobKeeper 2.1 extension changes?

On 21 July, the Government announced it is extending the JobKeeper Payment until 28 March 2021 and is targeting support to those businesses which continue to be significantly impacted by Coronavirus.

From 28 September 2020, eligibility for the JobKeeper Payment will be based on actual turnover in the relevant periods, the payment will be stepped down and paid at two rates.

Extension 1

The first extension period is from 28 September 2020 until 3 January 2021.

You will need to demonstrate that your actual GST turnover has fallen in the September 2020 quarter (July, August, September) relative to a comparable period (generally the corresponding quarter in 2019).

The tier 1 rate will be $1,200 per fortnight.

The tier 2 rate will be $750 per fortnight.

Extension 2

The second extension period is from 4 January 2021 until 28 March 2021.

You will need to demonstrate that your actual GST turnover has fallen in the December 2020 quarter (October, November, December) relative to a comparable period (generally the corresponding quarter in 2019).

The tier 1 rate will be $1,000 per fortnight.

The tier 2 rate will be $650 per fortnight.

How long will the JobKeeper payment last for?

On 21 July, the Government announced it is extending the JobKeeper Payment until 28 March 2021 and is targeting support to those businesses and not-for-profits which continue to be significantly impacted by the Coronavirus.

From 28 September 2020, eligibility for the JobKeeper Payment will be based on actual turnover in the relevant periods, the payment will be stepped down and paid at two rates.

How can I prepare for JobKeeper 2.1?

From 28 September 2020, you must do all of the following:

- work out if the Tier 1 or Tier 2 rate applies to each of your eligible employees and/or eligible business participants and/or eligible religious practitioners

- notify the Commissioner and your eligible employees and/or eligible business participants and/or eligible religious practitioners what payment rate applies to them; and

- during JobKeeper Extension 1, ensure your eligible employees are paid at least

- $1,200 per fortnight for Tier 1 employees

- $750 per fortnight for Tier 2 employees

- during JobKeeper Extension 2, ensure your eligible employees are paid at least

- $1,000 per fortnight for Tier 1 employees

- $650 per fortnight for Tier 2 employees.

What are the JobKeeper 2.1 business eligibility tests?

From 28 September 2020, businesses and not-for-profits seeking to claim JobKeeper Payment will be required to re-assess their eligibility for the JobKeeper extension with reference to their actual turnover in the September quarter 2020. Businesses and not-for-profits will need to demonstrate that they have met the relevant decline in turnover test in this quarter to be eligible for JobKeeper from 28 September 2020 to 3 January 2021.

Businesses and not-for-profits will need to further reassess their eligibility in January 2021 for the period from 4 January to 28 March 2021. Businesses and not-for-profits will need to demonstrate that they have met the relevant decline in turnover test in the December quarter 2020 to remain eligible for the March quarter 2021. See ATO website for more information >

JobKeeper Payments 2.1 employee eligibility?

- Employees that meet the eligibility requirements can now be nominated by a new employer if their original employment with a JobKeeper employer ended before 1 July 2020.

- As of 3 August 2020, the key date for assessing employee eligibility is now 1 July 2020, rather than 1 March 2020.

- For the fortnights commencing on 3 and 17 August 2020, employers have until 31 August 2020 to meet the wage condition for new eligible employees under the 1 July eligibility test.

I don't have a payroll solution. What does Reckon offer?

Are you new to Reckon but looking for a payroll solution? We’ve got easy and affordable solutions to suit all businesses. Get JobKeeper ready from just $10 a month! Learn more >