Debt factoring is a type of business financing. Predicated on having an accounts receivable ledger that has gone unpaid, or simply selling your accounts receivable ledger for quick cash to a third party, debt factoring is essentially a cash management technique.

As a bookkeeper or advisor, you’ll know that helping to protect cash flow is of prime importance to many clients – and any advice you can impart in this regard will be well received.

What is debt factoring?

Also called invoice factoring, accounts payable factoring, invoice financing or invoice discounting, debt factoring is a business strategy used to create instant cash flow from unpaid invoices.

Debt factoring is a form of outsourcing debt collection or striking a cash advance agreement. Debt factoring uses the technique of selling unpaid invoices to ‘factorers’ for less money than they’re worth in return for upfront capital. The third party then collects payment for invoices from the client directly.

These funds can be immediately reinvested into the business, and the accounts receivable ledger will be wiped clean, with no waiting period required.

How does debt factoring work?

Debt factoring is a form of business funding that uses one of a business’s most significant assets (its accounts receivable).

- A debt factoring provider will chase a business’s debtors for payment of unpaid invoices, collect the full invoice payment from them, and then pay the outstanding amount, minus a fee.

- The business will be paid usually a large portion of the invoice value almost immediately (from the point of raising the invoice), which, in turn, reduces their cash deficit.

- Debt factoring companies are proven to help businesses grow and prosper—engaging one could be an excellent alternative to a bank overdraft.

- The cost of debt factoring can vary but it’s mainly based on two things – a processing fee and a service fee. (These need to be considered when weighing up against traditional lending and other collection methods.)

When does debt factoring become attractive and viable?

Of course, if your client has a large set of unpaid invoices – or even a small number of unpaid invoices that amount to a significant sum – they’re certainly going to want to receive the money that they’re owed ASAP.

Accounts receivable is a reality of business for many Australian enterprises, but unpaid invoices can create serious cash flow stress.

Despite the merits of the method, there are many pitfalls to factoring. For smaller business clients especially, it’s often best they continue with other means of receiving payment from outstanding invoices, as debt factoring can be complicated. The outcome may not end up benefiting their bottom line in the short-term as they’d hoped, the process also requires long term commitment, and can be risk prone.

Sometimes, however, cash flow issues are so prevalent and acute for a business that this type of financing is preferable to business loans.

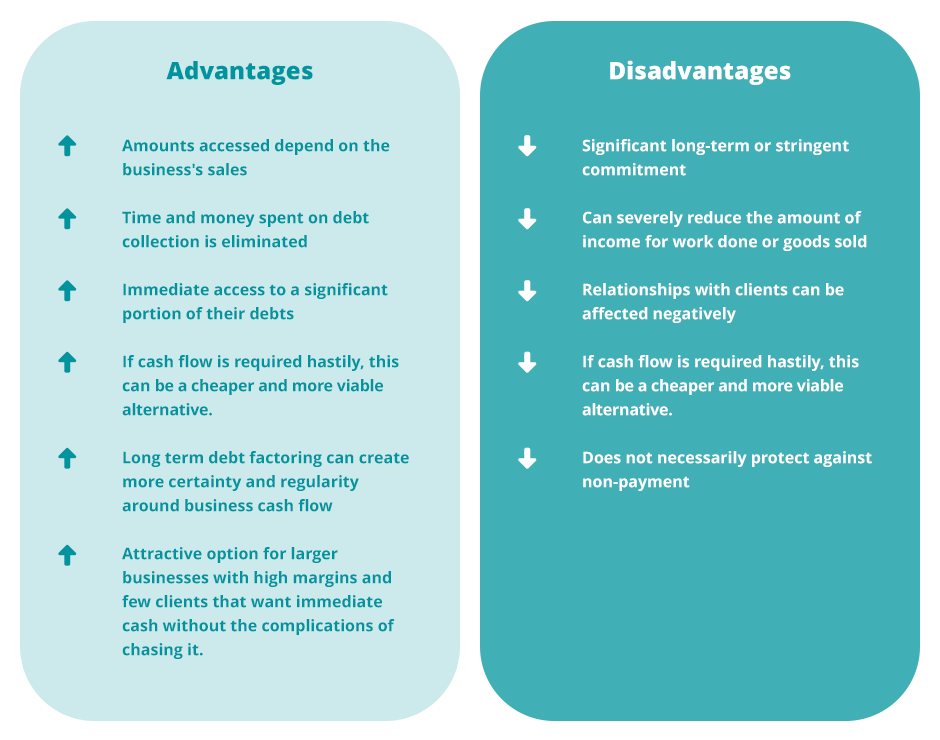

Advantages of debt factoring

- Debt factoring is a flexible alternative to a traditional, unsecured business loan because the amounts accessed depend on the business’s sales.

- The time and money spent on debt collection is eliminated.

- Businesses gain immediate access to a significant portion of their debts.

- If cash flow is required hastily, debt factoring can be a cheaper alternative to other forms of financing.

- Some businesses even rely on long term debt factoring to create more certainty and regularity around their business cash flow to fuel business growth – even if it comes at a price.

- For larger businesses with high margins and few clients that simply want immediate cash without the complications of chasing it, debt factoring may be an attractive option.

Disadvantages of debt factoring

- On the other hand, quick cash flow fix is not necessarily guaranteed as many Australian debt factoring companies require a significant long-term or stringent commitment.

- Debt factoring companies will also pay close attention to the financial health of their client’s debtors which can severely reduce the amount of money a business gets for work done or the cost of goods sold.

- Relationships between a business and its clients can be affected negatively when debt factoring companies get involved. For example, if a customer pays a debt factorer directly, the business may lose oversight of the relationship.

- As many debt factorers require repayment of the advanced invoice value, or a more expensive recourse agreement, debt factoring does not necessarily protect against non-payment.

How does debt factoring improve cash flow?

With 40% of invoices paid late, at an average of 26 days, Australia has the dubious honour of being one of the latest paying countries in the world.

Furthermore, the number one issue for most small businesses is cash flow. Most SMEs face enormous challenges if customers don’t pay bills on time—they need to settle their own debts and meet financial obligations like payroll, overheads, inventory, rent, rates, and a slew of other outgoings.

If cash flow disparity is stark and the payment of an invoice is the difference between paying your own expenses or defaulting – you can see why the immediacy offered by debt factoring is attractive, as it often alleviates cash flow delays. Of course, this comes at a price…

Advising your client around debt factoring

As a bookkeeper, take care when advising around debt factoring as a financing option and a remedy for cash flow issues. There are many disadvantages debt factoring and it is often an unsuitable cash management method for smaller businesses. Furthermore, there are other more sustainable ways of boosting cash flow and getting paid faster which can sidestep this option. However, if the situation calls for it, debt factoring is certainly a consideration worth exploring in more detail.