Payroll outsourcing is a rich area of client service expansion. Moreover, as automation takes hold of the bookkeeping and advisory industry, nimble ways to evolve your bookkeeping practice should be considered and embraced.

Because your customers (or potential customers) may have at least one person on their payroll, there’s a great opportunity in capturing those businesses in the market to outsource.

Offering payroll in your suite of bookkeeping services will be very attractive for a lot of employers, as farming out regulatory compliance admin can alleviate a host of busy, time-consuming work for them.

Better yet, there’s a variety of ‘levels’ to payroll support you can provide, from basic assistance to full service. In this way, you can appeal to an array of business types and sizes with different needs and requirements.

Understanding the nuts and bolts of payroll

Payroll in Australia is a term for remunerating employees. It refers to the various steps and processes involved in the timely and legally compliant paying of employees.

The term ‘payroll’ encompasses all forms of employee compensation, including salary, wages, benefits, and overtime. It also applies to all employees, despite their award or designation such as full-time, part-time, or casual. On a business’s books, payroll is listed as an expense—and it’s quite often the largest overhead in running a business.

Managing payroll means a business owner needs to be both fair with their employees and comply with a slew of Australian laws and regulations. There are many intricacies to running payroll, and many businesses will choose bookkeepers or accountants to undertake this responsibility on their behalf.

What is payroll tax?

Payroll tax is a state-based tax that is applied to the wages a business pays its employees. Payroll tax is self-assessed, and not applied uniformly on a national basis. Its thresholds differ from state to state.

Payroll tax will only apply to a business when its total payroll exceeds a certain threshold. (Again, the threshold will depend on the state or territory in which the business operates.)

As soon as a business exceeds the threshold, it must register for (and pay) payroll tax.

If a business operates in several states, or nationally, things get a bit more complicated. A business’s total Australia-wide payroll is considered in the various payroll state tax thresholds.

For example, let’s look at a business that operates in both Queensland and New South Wales and pays their total number of Australian employees a collective $105,000 per month.

If the NSW threshold is $101,000 and the QLD threshold is $108,000, this employer will have to register for payroll tax in NSW but not QLD.

Common payroll processes

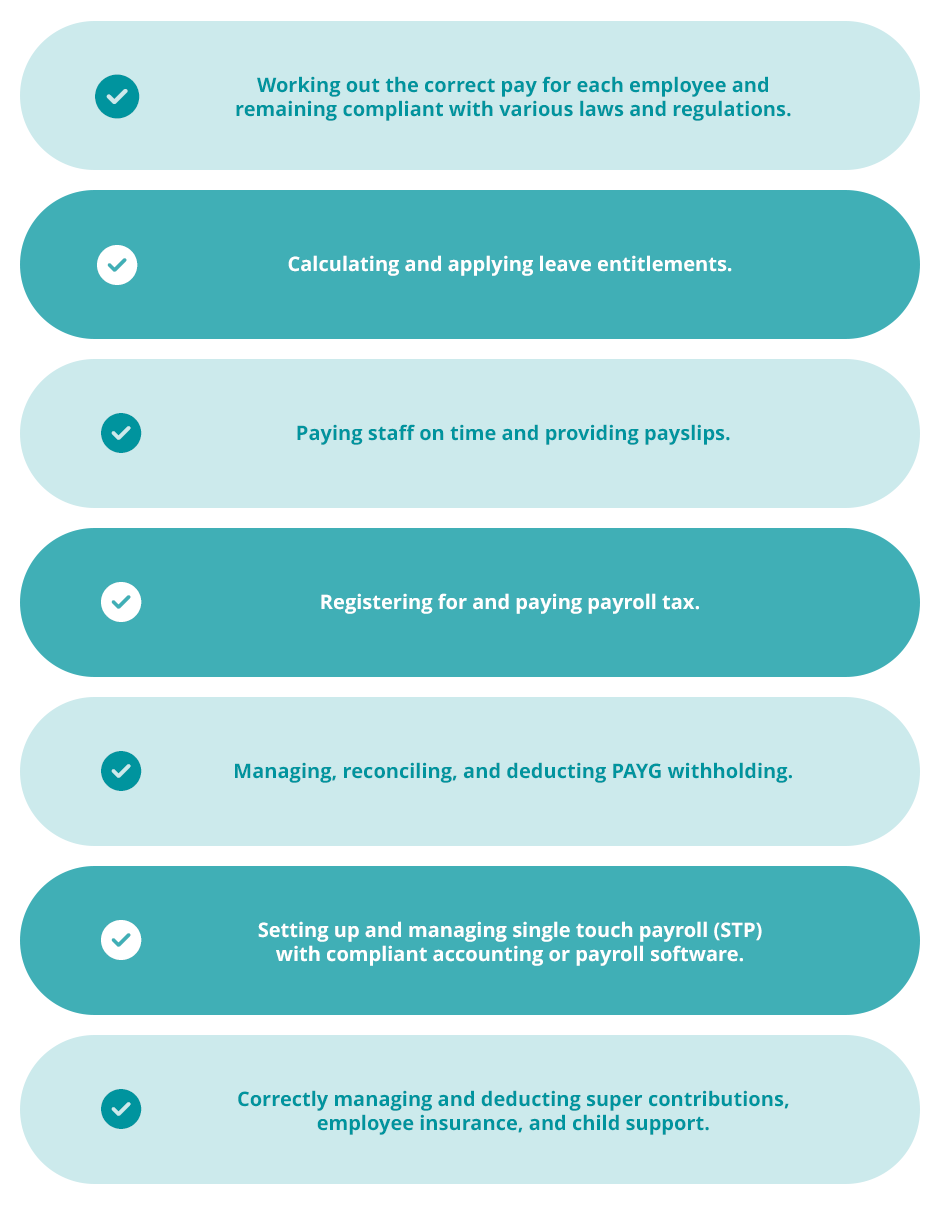

There are some common payroll processes most businesses with employees must undertake. These can be offered by your bookkeeping practice to business clients, either as a whole suite or broken up into various services as required.

On top of these processes, you can also offer payroll advisory services, to help your business clients set up a system to manage their payroll.

Payroll processes include:

- Working out the correct pay for each employee and remaining compliant with various laws and regulations.

- Calculating and applying leave entitlements.

- Paying staff on time and providing payslips.

- Registering for and paying payroll tax.

- Managing, reconciling, and deducting PAYG withholding.

- Setting up and managing single-touch payroll (STP) with compliant accounting or payroll software.

- Correctly managing and deducting super contributions, employee insurance, and child support.

What is payroll compliance?

Payroll compliance is the act of making sure a business’ payroll activity and processes abide by various state and national laws and regulations (many of which come from the ATO and the Fair Work Ombudsman).

Such compliance relates to everything from hiring and firing to payroll tax and accounting. With the possibility of penalties for non-conformance, the stakes are high to get it right.

As the risks of non-compliance are serious, this makes outsourcing payroll all the more attractive, creating ripe opportunities for bookkeepers to bear the load.

Selling a payroll service as a bookkeeper

Selling payroll assistance can either be your initial pitch to a business client or offered as an upsell or expansion on your usual bookkeeping services.

If you have current clients that uptake basic bookkeeping services from you, being able to offer payroll services as well could boost their account with you and their trust, not to mention your cash flow at tax time!

A client seeking your payroll services may own a large business with a range of employees and complex payroll requirements. Alternatively, your client may operate a simpler model with a handful of workers. This of course will impact the range and scope of services you offer them, along with budgets to suit.

Why do people outsource payroll services?

From a business owner’s point of view, they’ll be very conscious of their need to be payroll-compliant while also aware of the complexities and burdens that having staff on your books brings.

With so many plates in the air, a lot of employers choose to outsource payroll to a bookkeeper.

Often this choice to outsource payroll will come in two main guises:

- Full payroll service: Some businesses, particularly larger and more complex entities, will look to outsource their entire payroll management to a payroll provider.

- Partial payroll service: A smaller and less complicated business may only need you to manage the more complex aspects of payroll and set them up with payroll software to perform the day-to-day management. They don’t need a full payroll provider, just bits and pieces.

There’s wisdom in offering payroll outsourcing services across both service types to cater to each client.

Using a cloud payroll platform

Of course, many businesses will now be using cloud software to perform much of their payroll work. Often, a bookkeeper will use these tools themselves, or be able to log in to the client’s payroll software to perform their duties.

A canny bookkeeper will become familiar with and skilled at operating a wide range of the most popular accounting and payroll solutions.

Being able to tutor a client in the use of payroll software can be sold as a service in itself, particularly for DIY or semi-service clients who prefer a hands-on (albeit light touch) with their administration.