TABLE OF CONTENTS

- Reasons why you should only make claims with receipts

- How much can you claim on tax without receipts?

- How many kilometres can you claim on tax without receipts?

- 1) The logbook method (can use receipts but not required)

- 2) The cents per kilometre method (no receipts are required)

- When can’t you claim car expenses as a business deduction?

- How much fuel can you claim on tax without receipts?

- How much childcare can you claim on your taxes without receipts?

- Work-related expenses without receipts

When EOFY rolls around and you’re in the thick of filing your tax return, you’ll be asking yourself: what can I claim on tax without receipts?

Claiming tax deductions without receipts is generally to be avoided on your tax return, as compliance with the Australian Taxation Office (ATO) is paramount and your ability to produce proof of payment should be prioritised.

False tax deduction claims are intrinsically tied to a lack of record keeping and receipts, and the ATO takes a dim view of what could amount to non-compliant behaviour.

Whatever you do, make sure any tax deductible expenses on your income tax return are legitimate and provable.

Reasons why you should only make claims with receipts

- Diligently recording all your business-related expenses, complete with receipts, is your responsibility as an individual, sole trader or business.

- The ATO generally doesn’t look kindly upon the submission of expenses without receipts.

- The ATO needs to be able to witness and access proof of payment to ensure fairness and accuracy in all tax deductions, check total amounts, and be certain these claims are indeed business-related.

This leaves little room for tax deduction claims without proof come tax time. However, there are exceptions to this rule which allow for tax deductions without receipts on your tax return.

How much can you claim on tax without receipts?

Are you wondering “What am I able to claim on tax without receipts?” If you failed to keep receipts for your work-related expenses and wish to claim them on your tax return, how much can you claim without receipts?

Let’s be clear from the get-go – you should never rely on submitting a tax deduction without receipts or proof of payment for eligible claims.

Having said that, if you’re looking for tax deductions you can claim without receipts, what are your limitations?

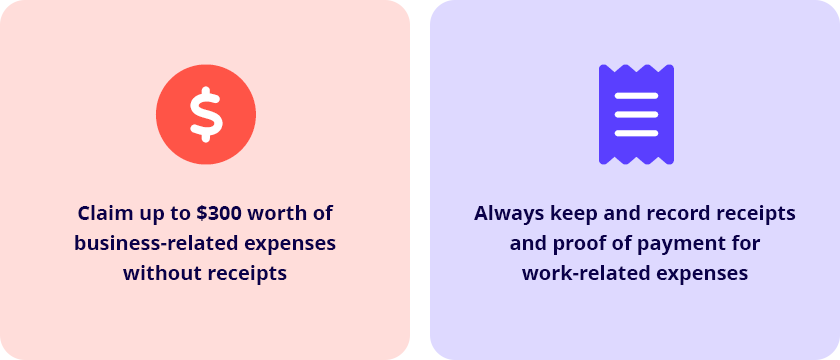

- You can submit up to $300 worth of business or work expense claims without the strict need for receipts.

- This is not a freebie and you should never attempt to pull the wool over the ATO’s eyes with false deductions.

How many kilometres can you claim on tax without receipts?

You can claim up to 5,000 ‘business kilometres’ per financial year for business- or work-related vehicle travel.

How does this work?

If you’re using a private car for business purposes – you can use two methods to calculate a tax deduction. Receipts can form a part of these calculations, if you see fit, but claiming kilometres without receipts is entirely possible and allowable.

1) The logbook method (can use receipts but not required)

For the logbook method:

- The logbook method involves you keeping a regular diary of your business-related car use. The ATO may need to see your logbook if they wish to.

- You’ll need to diarise odometer readings alongside car use notes in your logbook records.

- Expenses you can claim for include car running costs and any decline in the car’s value.

- You may not claim for the purchase price of the car itself, improvement expenditure or any loans you acquired to finance the car purchase.

- Your logbook must contain continuous use records for at least 12 weeks.

- When claiming for fuel and oil, you can choose to use receipts or estimates from odometer readings.

2) The cents per kilometre method (no receipts are required)

For the cents per kilometre method:

- You calculate your deductions based on the rate pertinent to the year you’re claiming for. For 2023–24 it’s 85 cents per kilometre. For 2022–23 it’s 78 cents per kilometre. For 2020–21 and 2021–22 it’s 72 cents per kilometre.

- You’re allowed to claim 5,000 business kilometres per car.

- You should be recording written evidence of your work-related trips for confirmation of use, such as a journal.

- You may need to provide written evidence to show how you worked out your business kilometres (for example, by producing diary records of work-related trips).

- If the car is shared by a joint owner who’s also claiming business use, you’re both entitled to 5,000 kilometres each.

For accurate details on how these options work, visit the ATO’s page on work vehicles, use their calculators and discover which works best for you.

You can also make use of the ATO’s myDeductions tool to keep track of your expenses throughout the year.

As always, chatting to your business advisor, accountant or bookkeeper is a wise move when deciding on how best to calculate vehicle and travel deductions.

When can’t you claim car expenses as a business deduction?

When claiming car expenses as a tax deduction, you need to be certain your vehicle use doesn’t violate the rules around business expenses.

You can’t claim for:

- travel between your place of business and home – this is classified as private use

- any expenses that have been salary sacrificed or reimbursed

- motorcycle use or any vehicle that’s not a car – these fall under separate travel expenses.

How much fuel can you claim on tax without receipts?

Using the logbook method, there’s scope for referring to your fuel and oil receipts to provide proof of expenses. However, this isn’t a strict requirement as you can also estimate the expenses based on odometer records.

You can claim any reasonable portion of use if you’ve clearly separated work from private use and your deductions are allowable under the ATO’s rules. See the rules around vehicle use and travel expenses here.

How much childcare can you claim on your taxes without receipts?

Put simply, you cannot claim the cost of childcare as a tax deduction. No receipts or proof of childcare payments of any kind is allowable to claim a tax deduction.

However, it may be possible for eligible taxpayers to claim childcare in specific circumstances by applying for the Child Care Tax Rebate (CCTR) through the Family Assistance Office.

What about claiming business expenses without receipts? As mentioned, you claim up to $300 worth of other business-related expenses such as laptop bags without the strict need for receipts.

This is a small concession by the ATO for low-cost expenses of limited scope but can be important for working from home expenses or home office equipment expenses.

You cannot, however, abuse the system and immediately claim $300 without actually having bought a work-related expense. This isn’t free money.

What you can claim on tax without receipts is very limited and you should always keep and record receipts and proof of payment for any business- or work-related expenses.

Remember, if in doubt, always talk to your registered tax agent, bookkeeper, or accountant.